24 November 2022 Edition

Flawed credit scheme could exclude 1 in 3 renters

• Cuckoo hedge funds enjoy tax advantages for new builds then rent them for extortionate prices whilst paying little to no tax

With 400,000 people renting homes in the 26 Counties, Anna Carroll explores the limits and deficiencies of the proposed tax credit for renters announced in Budget 2023, highlighting the imbalances that put tax breaks for cuckoo funds and landlords ahead of the lost generation of renters that are trapped in a bind of high rents and fear of eviction.

— • — • —

As part of Budget 2023, private renters will be able to apply for a tax credit worth €500 per year. However, as we know for this rental credit to be claimed, the landlord must be registered with the Residential Tenancies Board (RTB).

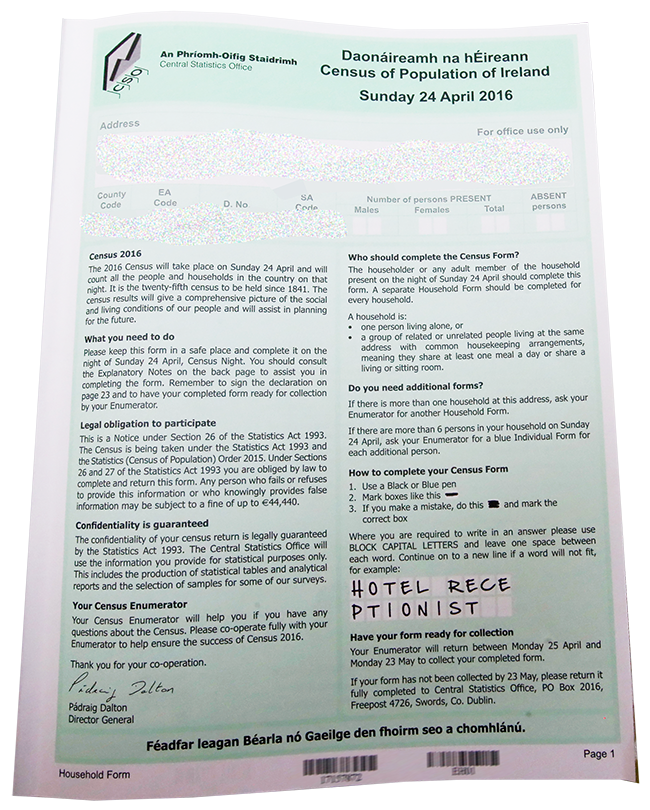

According to the CSO figures for 2021, there are nearly 400,000 renters in Ireland. The first official report from Census 2022 will be published in April 2023 which will give us a clearer picture of housing statistics in the State.

For the 400,000 private renters, we know many of these tenancies are not registered with the RTB which is required by law. According to the RTB, “Landlords who do not register a tenancy can be fined up to €4,000 and face imprisonment for up to 6 months on conviction”. However, less than €4,000 of fines were issued to landlords in three years for not registering a tenancy.

A sample check in Cork also found that 1 in 3 privately rented properties in the area around University College Cork were not registered with the RTB. If that study is in any way reflective of the total number across the State, that means there could be potentially 132,000 unregistered tenancies.

• Budget 2023 - Minister for Housing, Darragh O'Brien

Renters are ultimately punished because their landlord has not registered their tenancy and the onus is once again on them to make sure their landlords are following the law. Clearly, a system that relies on landlords to self-regulate is not fit for purpose.

As a renter myself, I’m sure I speak for many others when I say that there is a fine balance to be achieved when renting at the mercy of your landlord. We fear retribution from our landlords if we ask them to do basic repairs, let alone requesting RTB registration for our tax credits.

So, there is quite possibly going to be a situation where thousands of renters are not going to apply for this tax credit because it is not worth the danger of potentially becoming homeless or having a permanent rent increase. People will be afraid to claim what they are entitled to, and it is a fear that constantly looms over us. The government has refused to acknowledge the heavy power imbalance in favour of landlords against tenants without a lease.

• Census 2022 will give us a clearer picture of housing statistics in the State, when published in 2023

My landlord ‘joked’ with me that he ignores our messages because he “can’t be dealing with them” sometimes. What a powerful position to be in. It makes me angry, this constant uncertainty I feel and I know this is not the case for everyone but all the government has done in this case with the rental credit is barely treat the symptoms of the housing crisis with a rental credit, rather than curing it by increasing housing supply, bringing in a rent cap and strengthening eviction law which needs to be fairer to tenants all year round, not just in the winter.

Those who are evicted really have nowhere to go because of abject failures of government. Scotland has just introduced a rent freeze and also a moratorium on evictions which will continue until 31 March 2023. This will provide renters with much needed breathing space. Our Government continuously lacks this type of foresight. This rental tax credit will only inflate rents further because of the Government’s refusal to ban further rent increases.

On the other hand, people will welcome this rental credit initiative as perhaps a first step that the government is at least showing that they are trying. But then why are the cuckoo hedge funds continuing to enjoy tax advantages when purchasing newly built accommodation to rent them out at extortionate prices whilst paying little to no tax on their rental income? The Government’s consistent support in providing these favourable conditions for vested interests speaks for itself.

Ireland is lagging behind international best practice when it comes to legislating for renters like myself. We feel like a lost generation when it comes to both renting and purchasing a home. This rental credit initiative feels fatally flawed in its design, but I’ll hope for the best because I can’t do much else.

• Anna Carroll is a Digital Media Officer for Sinn Féin