16 October 2008 Edition

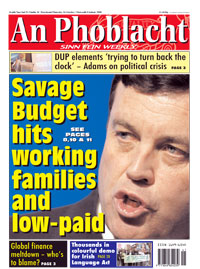

Budget attacks working families, low-paid, pensioners and unemployed

The 2009 budget: Coalition fails leadership test

RISING TAXES, spending cutbacks and a litany of stealth charges levied on those with the least ability to pay, this was Budget 2009.

By the time Finance Minister Brian Lenihan unleashed a strategy of savage cutbacks in a range of areas like health, disability, community and family affairs while increasing taxes on the least-well-off, he glossed it all over with the gimmick of a 10 per cent wage cut for ministers.

A 1 per cent income levy and 0.5 per cent increase in VAT, along with an 8 cent increase in excise per litre of petrol leaves tens of thousands of Irish families facing less disposable income every week and the clear message that it was they who would have to carry the cost of massive budget deficits and Government policy failures.

Here An Phoblacht outlines the core of Sinn Féin’s budget submission, Economy spokesperson Arthur Morgan’s key prime-time statement, and a user’s guide to what Sinn Féin had proposed should have been the details of Budget 2009 and what the Coalition actually did.

Realising Ireland’s Potential

An edited version of Sinn Féin’s budget submission

Sinn Féin believes that the economy can be turned around. It is essential that the Government uses the next 12 months intelligently to deal with the fall-out from the ongoing financial crisis and the construction sector’s collapse.

It must restore confidence and develop sound industries, particularly the indigenous export sector, build a more responsive and equitable social welfare process, and create a fair and progressive taxation system.

This Budget should aim to:-

• Stabilise and reinvigorate the economy;

• Prioritise job creation;

• Address the massive shortfall in public finances;

• Deal with the needs of low-income and middle-income earners facing cost-of-living pressures;

• Provide solutions for those who have become unemployed or who face unemployment.

Sinn Féin’s proposals and what the Fianna Fáil/Green Party/PD coalition did

JOB CREATION – SINN FÉIN’S CORE BUDGET PRIORITY

Sinn Féin believes that the crucial area of job creation and enterprise has been overlooked as the main means of rebuilding our struggling economy and creating revenue while lessening the pressure on social welfare expenditure.

We pay special attention to our under-performing indigenous export sector. A 2006 Forfás report showed that foreign-owned firms based here were responsible for 90.2 per cent of exports from Ireland that year.

This included manufacturing and internationally traded services and amounted to €96.4 billion. Total exports of Irish-owned manufacturing and internationally traded services firms only amounted to €10.5 billion. This is an area crying out for Government intervention and stimulus.

There is also an opportunity to create jobs within the domestic manufacturing sector, particularly the food and drinks processing industry, through import substitution initiatives.

Lenihan’s Budget There were no new incentives in the Budget for job creation except the meagre proposals of increasing R&D tax credit from 20 per cent to 25 per cent and a remission for new businesses paying Corporation and Capital Gains taxes in their first three years of operations.

There were no new incentives in the Budget for job creation except the meagre proposals of increasing R&D tax credit from 20 per cent to 25 per cent and a remission for new businesses paying Corporation and Capital Gains taxes in their first three years of operations.

BUILDING THE FUTURE

Sinn Féin believes that key public infrastructure projects, necessary to achieve competitiveness, must be proceeded with and not cancelled or postponed. These include, in particular, public transport infrastructure and social infrastructure, such as schools and housing regeneration projects.

We propose that the Government invests money from the Pension Reserve Fund in public infrastructure projects, rather than in less stable international stocks and shares, for the next year at least.

At the end of 2007, the National Pension Reserve Fund contained €21.2 billion; in March 2008, the fund was estimated at €19.4 billion.

Lenihan’s Budget

The 2009 capital investment project includes mostly projects already underway. No new initiatives on funding public transport expanding Bus Éireann or Dublin Bus. Funds for national school building will be cut by 5 per cent in 2009. Social Housing spending will be cut by 2 per cent in 2009 with a 30 per cent cut in funding for affordable housing.

SINN FÉIN’S PUBLIC FINANCE PROPOSALS

1) Increase the PAYE tax credit from €1,830 to €1,921.50 (a 5 per cent increase to meet the annual increase in the cost of living) – cost €130 million, PQ 321, 24 September 2008.

2) Introduce a bank levy as part of the terms and conditions of the emergency Credit Institutions Bill. The state should also take a shareholding in the banks as a guarantee of benefit to the Exchequer.

3) Proceed with the removal of the PRSI ceiling.

4) Increase motor tax for the highest emissions non-commercial vehicles (Class F and Class G) – raises €610,000, PQ 1386, 24 September 2008.

5) Introduce a 1 per cent increase in the health levy for those earning in excess of €100,000 (the revenue raised to be channelled into increasing the income threshold for the Medical Card).

6) Make all discretionary tax relief schemes available only at the standard rate, exceptions should be made only if there is a proven benefit to the Exchequer – Raises €1 billion, PQ 28, 25 September 2008.

7) Introduce legislation to end tax exile status.

8) Introduce legislation, as exists in other EU states, obliging tax lawyers to register tax avoidance schemes.

9) The Government, through the Commission on Taxation, to undertake a rolling review of taxation, to increase the number of income tax bands in order to assist those on low and medium incomes, many of whom are paying too much tax, and ensure that those on higher incomes are paying their fair share.

10) Increase the price of a packet of cigarettes by €2 - raises €320 million, Irish Cancer Society (consider removal of Nicotene patches from the high rate of VAT or making Nicotene patches available on the Drugs Refund Scheme).

11) End state subsidies to private schools.

12) Increase Deposit Interest Retention Tax by 5 per cent - raises €130 million, PQ 85, 25 September 2008.

13) Double betting duty from 1 per cent (betting duty at this rate in 2007 amounted to €36.44 million) and reverse the 2002 Finance Act’s exemption of tax for on-course betting.

14) Extend the pay pause for civil servants of principal officer level (above €80,000).

15) Withhold payment into the National Pension Reserve Fund for one year - raises €1.69 billion, PQ response 242, 30 September 2008.

16) Reduce expenditure on consultants by Government departments (the Department for Defence, for example, has spent €2.1 million this year on an awareness campaign on emergency planning - PQ 1385, 24 September 2008).

17) Introduce targets to reduce carbon emissions, aimed at curtailing our need to purchase carbon credits in 2009.

18) Exceed EU borrowing limits.

Lenihan’s Budget

Lenihan didn’t change PAYE tax credit but did raise the standard 20 per cent tax rate by €1,000, taking some 23,495 earners off the top rate of tax. However, this small, positive move was offset by the imposition of a new income levy at 1 per cent on incomes of up to €100,000 and 2 per cent on incomes above that. He put 50 cent on a packet of cigarettes; Sinn Féin had proposed €2.

Levy did increase the betting tax levy and increase DIRT by 3 per cent. Sinn Féin had suggested 5 per cent.

However, to add to the burden of the new 1 per cent levy, he increased the standard rate of income tax by 0.5 per cent.

SOCIAL WELFARE PROPOSALS

1) Increase the Family Income Supplement from 60 per cent to 70 per cent of the difference between income and the payment threshold (cost €33 million - St Vincent de Paul).

2) Ensure that accessing Family Income Supplement is automated through a flagging mechanism within the tax/welfare systems similar to that used for new Child Benefit claims.

3) Increase the basic rate of welfare and pensions by €15 per week as recommended by St Vincent de Paul (cost €908 million).

4) Increase Living Alone pension payment from €7.70 to €15 a week, in line with Combat Poverty recommendations (cost €20 million).

5) Extend the fuel allowance period from 30 to 34 weeks and increase the weekly allowance by €12 (cost €132 million – St Vincent de Paul).

6) Reduce the eligibility criteria for Back to Work Allowance (BTWA) and Back to Work Enterprise Allowance (BTWEA) to 12 months.

7) Introduce a cost of disability payment (the Department of Social and Family Affairs’ Sectoral Plan, Towards 2016, and the Programme for Government agreed to consider this issue).

8) Retain the Combat Poverty Agency as an independent body (cost €4.568 million).

Lenihan’s Budget

Lenihan increased pensions by €7 a week and welfare payments by €6.50. Sinn Féin had proposed a €15 a weekly increase.

He increased the fuel allowance period by two weeks. Sinn Féin had suggested four and increasing the weekly allowance by €12 a week. Lenihan increased it by €2.

At the same time, Lenihan introduced a series of measures to make it harder to get Job Seeker’s Benefit. You used to need 52 weeks at work to qualify; now you need 104.

Combat Poverty and the Office of Social Inclusion will be integrated into the Department of Social and Family Affairs.

CONSTRUCTION WORKERS AND MORTGAGE SECURITY

It is estimated that a minimum of 30,000 construction workers have lost their jobs so far in 2008. A strategy to get these workers back into employment and/or training is essential.

Sinn Féin is proposing the following measures be taken:

1) A specific Back To Education Scheme for construction sector workers under the age of 25 without Leaving Certificates. The Department of the Taoiseach estimates that under-25s represents 50.3 per cent of the total construction unemployment figure in 2007 and 2008 and that a large majority do not have a Leaving Certificate (PQ 174, 24 September 2008).

2) Provide training and up-skilling courses for alternative industries to construction through FÁS and third-level institutions. Also, provide retraining for construction workers so they can work in the energy saving and renewable energy sectors

3) Deal with the predicament of construction sector workers who were pushed into becoming self-employed (C2 workers) by their employers and who do not have adequate stamps to access social welfare entitlements by allowing stamps for the last five years to be considered for their welfare payments rather than the two-year previous criteria (Governing Contribution Year) currently applied.

4) Frontload infrastructure projects that can employ workers from the construction sector while increasing our competitiveness, including transport, school, crèches, social housing and hospital builds.

5) Increase Mortgage Interest Supplement for people out of work.

6) Increase funding for MABS using a proportion of a new bank levy introduced as part of the Credit Institutions Bill.

7) Place a requirement on banks, as part of the Credit Institutions Bill, to take all the steps necessary to protect low income/unemployed people facing mortgage default and home repossession, including rescheduling payments or allowing interest-only payments for a period of time.

Lenihan’s Budget

He did not address any of these issues.

HEALTH SERVICES AND INEQUALITY

Sinn Féin proposed the following specific measures:-

1) No removal of Medical Card entitlement from any sector, including those who become entitled when they reach 70.

2) Abandon the private hospital co-location scheme.

3) End tax subsidies and other pay-outs to the private health industry.

4) Index the income thresholds for Medical Cards to increases in the average industrial wage (commitment in the 2007 Agreed Programme for Government.)

5) Double the income limit eligibility for Medical Cards of parents of children under 6 years of age, and treble them for parents of children under 18 years of age with an intellectual disability (commitment in 2007 Agreed Programme for Government).

6) Immediately establish a Health Funding Commission to report within a year on the costs of the transition to a new single-tier, public health system with universal provision, taking into account all spending on health services under the current systems, including state funding and spending on private health insurance.

Lenihan’s Budget

Lenihan withdrew automatic entitlement to a Medical Card for the over 70s. It will now be means tested. A&E charges will increase by 50 per cent, to €100.

BUDGET 2009

THE SINN FÉIN RESPONSE

SINN FEIN’S Economy spokesperson Arthur Morgan summed up the Coalition Budget, highlighting its three key failures: it does nothing for job creation, it attacks working families, and it undermines the vulnerable and deprived in society.

SINN FEIN’S Economy spokesperson Arthur Morgan summed up the Coalition Budget, highlighting its three key failures: it does nothing for job creation, it attacks working families, and it undermines the vulnerable and deprived in society.

Morgan told the Dáil on Budget Day:

“Sinn Féin approached this Budget prepared to support any measures that would stabilise and reinvigorate the economy; prioritise job creation, address the massive shortfall in public finances, deal with cost-of-living pressures, and provide solutions for those who have become unemployed or who face unemployment.

“We argued for the Government to see this budget as an opportunity to turn around the Irish economy. We wanted a budget that was about more than just balancing the books – an approach we believe has the potential to drive us further into recession, rather than lift us out of it. We wanted it to show vision for a new economic model, one based on sound industries like R&D, exports and a thriving indigenous SME sector capable of delivering the revenue needed next year to revive the public finances.

“Today, people wanted to see the beginning of a three-year plan to get the economy back on track. Central to that is creating and retaining jobs and addressing the shortfall in public finances. The Government fell far short on both counts today. They failed the leadership test.

“They promised to look after the most vulnerable but they didn’t. They said that they would ensure that top earners paid their fair share but they didn’t. They promised frontline services in health and education would be protected but that didn’t happen either.

“We can rebuild the economy but that means taking bold decisions. It means investing in infrastructure that will create jobs and build competitiveness. It means helping those who have lost their jobs get back into the workforce as quickly as possible and ensuring that they are supported properly while that happens. It means ending the era of tax breaks for the rich while PAYE workers struggle to survive.

“Change is possible and it should have started here today. It didn’t, and the state will be poorer off next year because of it.”

Lenihan’s twisted patriotism

“THIS is a recipe for emigration and Brian Lenihan will be standing at the airport to take €10 flight tax out of your pocket as you leave” was how Sinn Féin TD and Dáil Leader Caoimhghín Ó Caolain aptly summed up the initial reaction of many to the Budget.

This was a disastrous Budget. It will not stimulate the economy but will instead actively penalise work and spending. It doesn’t promote enterprise and it undermines the already precarious position of thousands of families enduring deprivation.

All the soundbites and hand-ringing about protecting the vulnerable came to nothing as even the lowest-paid workers will now have to fork out not just a 1 per cent tax levy but higher prices on everything they buy through the VAT increase.

Working families will be paying more tax. And Dublin’s commuter-belt workers driving daily to the city and suburbs will also have to pay 8 cent a litre more to do so because the absence of strategic investment in public transport means they are car dependent. For an average driver its adds up to €200 a year extra in extra tax on top of which they will now have to pay another €200 annually for the parking space needed for their cars. Wouldn’t it be easier to invest in the buses and trains that could take us to work daily?

Not in the mind of Brian Lenihan.

He has dipped deeply into our pockets through higher hospital charges, fewer Medical Cards, less money for new schools or social housing, reduced Child Benefit and below-inflation increases for welfare recipients and pensioners.

Every ordinary citizen is worse off as a result of this Budget.

Brian Cowen said this Budget is “a call to patriotic action”, but is it really a patriotic action that makes the poor and the old and low-wage families pay proportionally more to deal with Government failures?

And isn’t it interesting that although Brian Lenihan ignored the advice or requests of the ESRI, Focus Ireland, ICTU, St Vincent de Paul, the Carers’ Association, Barnardos, the Irish Cancer Society and many other socially-minded groups, he still found the room to meet the requests of the Construction Industry Federation for a cut in stamp duty on commercial property. We may have a new Finance Minister but it is the same old Fianna Fáil.