3 July 2017

Why is Fine Gael sabotaging corporate tax transparency initiative?

● Fine Gael MEP Brian Hayes – voting for or against transparency?

At the last minute, the liberals and the EPP group – which Fine Gael is part of – banded together to introduce under which corporations can be exempted from reporting requirements on the grounds of ‘commercial sensitivity’

OPINION

Matt Carthy is a Sinn Féin MEP and a member of the European Parliament’s Panama Papers inquiry committee and Economic & Monetary Affairs Committee

ON TUESDAY in Strasbourg, MEPs will vote on a vital report on corporate tax transparency.

For more than a decade, civil society, NGOs, tax justice activists and academics have been campaigning for the introduction of country-by-country company reporting. This means that multinational corporations would be required to publicly report their turnover, profits and tax paid in each country in which they operate.

New figures published by the Tax Justice Network in March estimate that profit-shifting by multinationals results in around US $500billion in tax being lost each year.

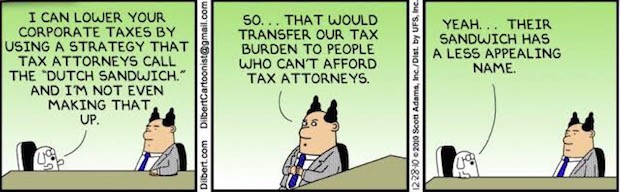

This offshore scam affects us all.

Public country-by-country reporting is not a measure that would impose any restrictions on what corporations can and cannot do but it is a measure that would lift the veil on their global activities.

It would allow ordinary people to become aware of instances where tax dodging and profit shifting by large corporations is taking place, and to exert public pressure on them to change their damaging behaviour.

It would also level the playing field for small and medium businesses currently disadvantaged as they pay more tax than multinationals.

After intensive corporate lobbying, the country-by-country reporting proposal made by the Commission and now before the Parliament is riddled with exceptions and loopholes.

Instead of applying to companies defined in EU law as “large” (with a turnover of more than €40million per annum) the proposal was applicable only to massive corporations with a turnover of more than €750million per annum. This automatically excludes around 85% of corporations.

The second most significant failure of the Commission’s proposal was that it did not require companies established in the EU to report their operations separately for each country – it would be broken down by EU member state but only on an aggregated basis for non-EU operations, and disaggregated only for jurisdictions that are on an as yet to be determined tax haven blacklist that.

In all likelihood, this EU blacklist will be based on the OECD (Organisation for Economic Co-operation and Development) blacklist which (as of this week) has just a single jurisdiction on it – Trinidad & Tobago.

Notorious tax havens such as Panama, Bermuda and the Cayman Islands? They’re fine, according to the OECD.

This issue of ‘disaggregation’ (actually breaking down the information for each country) is crucial in order to examine the patterns of profit shifting and will impact in particular on developing countries.

MEPs took a more progressive position on many issues than the Commission does and the draft report in Parliament would have strengthened the proposal significantly. But, during negotiations at committee stage, conservatives and liberals opposed the progressive groups and won a small majority in favour of limiting the proposal to companies above the €750million threshold.

It appeared as though the Parliament’s economic committee would take a strong position on the question of disaggregation but, at the last minute, the liberals and the EPP group – which Fine Gael MEPs Brian Hayes, Deirdre Clune, Seán Kelly and Mairéad McGuinness are part of – banded together to introduce a so-called “safeguard clause” which can be forever renewed and under which corporations can be exempted from reporting requirements in one or more jurisdictions on the grounds of “commercial sensitivity”.

This is a loophole you could drive a truck through and will allow profit-shifting to tax havens to continue unhindered.

It is appalling that conservative MEPs are siding with multinationals in order to block tax transparency.

This is a major step backward from the Parliament’s previous majority position of supporting measures to inform the public about what multinationals pay in taxes and where.

The conservatives and liberals have clearly decided that protecting tax cheats is more important than protecting the public interest.

Together with other progressive MEPs, I have proposed several amendments to the report.

We are calling for the reporting requirements to be on a disaggregated basis – without the “safeguard” loophole – and to apply to all large companies with a turnover of more than €40million.

We are urging every MEP who cares about the public interest to vote in favour of these amendments to ensure the Parliament takes the strongest position possible before entering negotiations on the text with the Commission and the Council – whose position is even worse than the Commission’s.

The Irish Government introduced country-by-country reporting for companies with a turnover of more than €750million, in line with the OECD BEPS (Base Erosion and Profit Shifting) recommendation.

But it has not introduced the requirement that the reporting be made public – and Irish Government representatives have made it clear that they will oppose in the Council the financial data being made public.

Maximum EU and international transparency on tax is not a threat to tax sovereignty, which I have always supported and which is a key principle of Sinn Féin’s engagements with the EU.

The only people with anything to fear from tax transparency are tax cheats and their cheerleaders.

There is no evidence to support the argument that public CBCR (Country By Country Reporting) will impact on the competitiveness of EU-based companies. It has already been introduced for the largest banks and extractive industries in the EU, and these industries have not reported any reduction in their competitiveness.

There has, however, been increased public scrutiny of tax dodging.

Using the public figures from 2015 from the banking sector, Oxfam reported in March irrefutable evidence that the Irish state was being used to facilitate massive tax avoidance in the financial sector.

Five of the biggest banks reported profits in Ireland of more than 100% of their turnover – something that can only be achieved through blatant profit shifting.

Their findings vividly illustrate the value of country-by-country reporting being made public instead of the figures only being provided to state tax authorities.

● New Fine Gael leader and Taoiseach Leo Varadkar

The Irish Government should stop playing an obstructionist role on transparency by opposing public country-by-country reporting in the Council and commit instead to advocating for maximum tax transparency.

Public financial reporting on a country-by-country basis is arguably the most important development that has been proposed so far when it comes to tackling tax avoidance.

We need to get it right.

Fine Gael seems determined to resist full transparency on corporate taxation, whether it is in the Irish Government, in the European Parliament, or in the Council.

This Tuesday in Strasbourg, Fine Gael MEPs have an opportunity to stop siding with corporate tax cheats and vote in favour of our amendments to scrap the so-called safeguard clause that will weaken the Parliament’s position on this vital transparency initiative.

I hope they take this opportunity.