5 December 2011

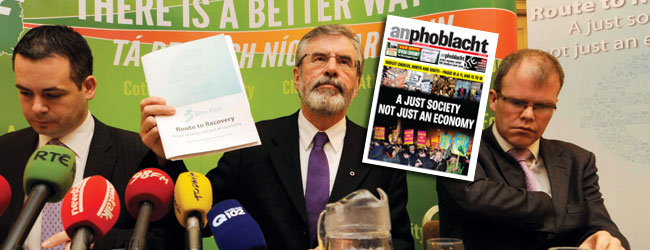

Route to Recovery - A just society, not just an economy

BUDGET 2012

Sinn Féin’s economic alternative

Time to make different political choices

The Irish economy is still in deep crisis, the recession is far from over and Irish society is suffering. Last February, Fine Gael and Labour promised ‘new government, new policies’. Instead, they are delivering Fianna Fáil policies with the same devastating consequences.

Since 2009, €20.6billion has been taken out of the economy in an attempt to close the deficit. It has not worked. Government policies are depressing the domestic economy, reflected in lower tax receipts and higher social welfare costs.

Nearly half a million people are unemployed. Two hundred and ten thousand ESB and Bord Gáis customers are in arrears. Young people are leaving our shores in their droves. Tens of thousands of construction workers are without work when we could be using their skills. One hundred thousand households are in mortgage distress. Families are in despair. Economic sovereignty is being given away. The Fine Gael/Labour Government is living in a bubble - cut off from the social consequences of the decisions it takes.

We are a divided society - a society of haves and have-nots, of those who have wealth and those on the breadline; of those who created the economic crisis and those who are being forced to pay the price for it. The decision-makers have still not got the message. There may have been a change of government but the new government is prepared to unleash on the Irish people a Budget that will have negative and far-reaching consequences for ordinary working families and on the poor.

Further devastating cuts to vital services and social supports are about to be visited upon this society, causing more inequality and social problems, and further depressing the economy.

There are powerful groups and individuals in this state whose sole interest is to protect the status quo. We just have to look at the priorities of the Fine Gael/Labour Government and the previous Fianna Fáil-led Government and see who they are asking to bear the brunt of this recession.

They have implemented:-

» Cutbacks in special needs education

» Cuts to the Carer’s Allowance and Carer’s Benefit and to the home help services.

» Cuts to those reliant on social welfare - cuts to the Household Benefits Package which provides a range of assistance for pensioners, carers and people with disabilities.

» Cuts to homelessness services of 10%.

» Attacks on low-income and middle-income earners - family stealth taxes, household charges, water charges, the Universal Social Charge and cost of living increases.

» Exorbitant salaries for Government appointees - some paid five times the average industrial wage (€168,000 awarded to senior Government advisers, breaking the Government’s own salary cap!).

» Massive salaries and pensions - The new ESB CEO awarded a salary over 30% in excess of the Government’s own pay ceiling for commercial semi-states; 14 senior executives in the National Treasury Management Agency paid more than a quarter of a million euro per annum.

Fine Gael and Labour have also failed to renegotiate the EU/IMF deal and are complicit in handing away economic as well as political sovereignty. Meanwhile, they continue to use taxpayers’ money to pay private bank bondholders. On 2nd November, €715million was paid to an unguaranteed, unsecured bondholder in Anglo. A further €1.25billion will be paid to another unguaranteed, unsecured Anglo bondholder in January 2012.

Fine Gael and Labour pursuing the policies of Fianna Fáil will not fix the economy. It will further depress the economy - taking more money out of circulation, closing viable businesses, increasing unemployment and putting families and whole communities below the breadline. This comes down to political choices. You can choose to pay €715million to an unguaranteed bondholder in Anglo or you can choose to protect families, low-earners, public services and Irish businesses.

Sinn Féin’s economic alternative

In this pre-Budget submission, the political choices Sinn Féin makes are about achieving a far fairer yet still successful route to recovery.

Sinn Féin’s plan is about growing the economy to a sustainable recovery, making sure the most vulnerable are protected, that those who can afford to contribute more are asked to do so, and bringing a level of equality not seen in this state.

» Invest €7billion in job creation and economic growth over the next three years, including using semi-states as a driver for recovery. This proposal would benefit almost 200,000 people.

» Close the deficit between 2012 and 2016, beginning with €3.5billion this year. The Government is making an adjustment of €3.8billion, but claims €600million of this will be carry over from last year, so €3.2billion of this is from new measures. We are targeting €3.5billion to allow for the impact that some measures will have against others. Our plans will make deficit to GDP 8.3%. We achieve €3.5billion by reducing the tax burden on low-income to middle-income families, increasing taxes and removing loopholes for higher earners, as well as spending savings.

» End wasteful spending, beginning with €1billion in savings this year through a range of measures including capping all public sector wages at €100,000, reducing professional fees by 25% and ending the practice of providing medical care for private patients in public beds.

» Support working families and the most vulnerable - abolish the USC and invest in a household stimulus package to help those struggling to survive. Abolishing the USC will benefit half a million people by taking them back out of the tax net.

» Maintain social welfare levels and oppose the introduction of student fees, household and water charges.

» Ease the recruitment embargo in the public sector to hire nurses, teachers, SNAs and gardaí.

» Tackle the debt crisis - Irish debt levels are unsustainable. A Europe-wide solution is needed to deal with the debt problem. As a first step, private bank debt and sovereign debt must be separated and the Anglo promissory notes, which will cost €74billion over the next 20 years, should not be paid.

» Stand up for Ireland and negotiate a new EU/IMF deal.

Financial measures

Adjustment of approximately €3.5billion to the deficit

after tax and spending adjustments are made.

Job creation package of €7billion.

Household stimulus package of €596.7million.

Tax raising

Net total €3.263billion

Income taxes

Introduce a new third rate of tax of 48% on income earned by individuals in excess of €100,000.

Raises: €410million

Adjust PRSI exemption for share options, shared-based remuneration and capital gains.

Raises: €97million

Abolish the USC.

Cost: €4.1billion

Reintroduce the income levy (reducing the 2% to 1% on income up to €75,000) and the health levy:

8 Raises: €3.118billion

Wealth taxes

Introduce a wealth tax of 1% on all assets in excess of €1million, excluding working farmland, business assets and the first 20% of value of the primary residence.

Raises: €800million

Increase Capital Gains Tax from 25% to 40%

Raises: €195million

Increase Capitals Acquisitions Tax from 25% to 35% and reduce the thresholds by 25%.

Raises: €165million

Tax reliefs and loopholes

Place an earnings cap of €80,000 on pension contributions and grant relief at 20%.

Raises: €550million

Abolish the ability of incorporated bodies to claim trading losses against profits made in previous years for tax return purposes.

Raises: €108million

Halve mortgage interest relief for landlords.

Raises: €400million

Standardise discretionary tax reliefs, excluding donations to charity.

Raises: €628.3million

Abolish ‘Group relief’ availed of by companies to transfer losses to profitable companies and write down tax receipts.

Raises: €450.3million

Abolish legacy property reliefs.

Raises: €341.8million

Introduce 5% tax on online gambling.

Raises: €100million

Savings

Net total €837.25million

Apply charges based on the full economic cost for the use of beds in public and voluntary hospitals in the state for the purposes of private medical practice.

Saves: €372.744million

Implement full generic substitution of medicines under the GMS scheme and clamp down on over-prescriptions.

Saves: €200million

Cap all public servants’ wages at €100,000 per annum.

Saves €265million

Cap commercial state-sponsored bodies’ CEO pay at €100,000.

Saves: €3million

Cut all state agency board fees by 25%.

Saves: €6.7million

Target a reduction of 25% in professional fees across departments, excluding Health.

Saves: €38.5million

Cap Government salaries at €100,000, TDs at €75,000 and Senators at €60,000.

Saves: €4.3million

Phase out state subsidy of private schools while continuing to make provision for minority schools.

Savings: €20million

Reduce spending on rent supplement by providing social housing.

Saving: €20million

Recoup social transfers paid to wrongfully dismissed employees from employers.

Saves: €12million

Reform social welfare system to make it easier for job-seekers to avail of casual work.

Saves: €40million

Remove the recruitment ban to hire frontline staff for Sinn Féin’s jobs investment projects such as schools and primary care centres. This would allow for the employment of approximately 3,500 extra frontline staff.

Cost: €145million

Job stimulus

Cost €7billion

€7billion to be provided from €5.3billion in the National Pension Reserve Fund and €1.7billion from the European Investment Bank for a three-year investment package: 60,000 jobs created directly, thousands more indirectly and up to 96,000 saved

Full details in the Sinn Féin pre-Budget submission www.sinnfein.ie

Household stimulus

Cost €596.7million

Fund a central schoolbook provision scheme for all schoolchildren, which would see books provided free of cost to schools for children’s use.

Cost: €60million

Provide every primary schoolchild in the state with a free lunch meal.

Cost: €250million

Reverse changes to the non-adjacent grant for third-level students.

Cost: €43million

Return the 200 SNAs cut in the last Budget.

Cost: €6million

Remove the levy on medical card prescriptions.

Cost: €24million

Make tax credits refundable.

Cost: €140million

Reverse the cuts to the Household Benefits Package.

Cost: €25million

Restore the cut of €3.90 made this year to Fuel Allowance recipients in smokeless zones and extend that increase to all recipients.

Cost: €48.7million.

€596.7million paid for from excess in taxation and savings measures

Follow us on Facebook

An Phoblacht on Twitter

Uncomfortable Conversations

An initiative for dialogue

for reconciliation

— — — — — — —

Contributions from key figures in the churches, academia and wider civic society as well as senior republican figures